UPI Collection API

What is UPI Collection API?

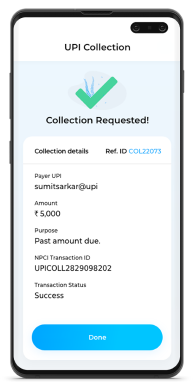

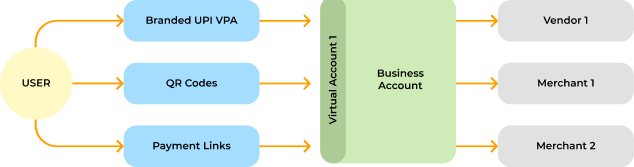

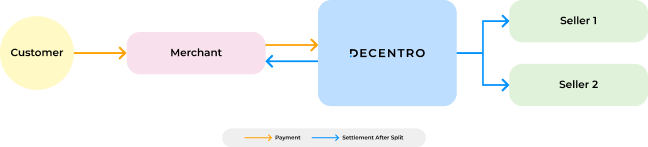

The Unified Payments Interface (UPI) system in India facilitates seamless digital transactions, and the UPI Collection API is a powerful tool for businesses and merchants to collect payments efficiently. By generating customized UPI payment links or QR codes, merchants allow customers to make instant payments directly from their bank accounts.

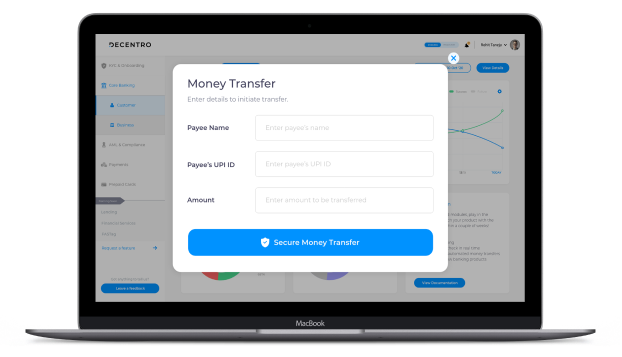

Our UPI portal provides a user-friendly platform where customers can initiate payments and manage transactions with ease. It eliminates the need for cash or card transactions, offering a secure, fast, and hassle-free payment experience.

With real-time transaction logging, payment acceptance, and reconciliation, the UPI Collection API simplifies payment processing for businesses. It not only enhances operational efficiency but also supports India's drive toward a cashless economy, contributing to the growth of the digital payment ecosystem. For businesses, it’s a reliable and scalable solution to meet the demands of modern payment methods.